The broadly accepted definition of money laundering is: “The process by which criminals seek to conceal the true origins and/or ownership of the proceeds, or benefits, of criminal activity“.

The aim of the process, from the criminals’ perspective, is, therefore, to achieve a situation where the proceeds of their activities appear legitimate; this can enable them to avoid prosecution, conviction and the confiscation of the criminal funds.

How is the offense of Money Laundering committed

Criminals use financial institutions as the major conduits to assist in these activities. This means that it is important that those working in the financial services sector are fully aware of the regulatory requirements in respect of money laundering, and of their personal responsibilities.

When a criminal activity generates substantial profits, the individual or group involved must find a way to use the funds without drawing attention to the underlying activity or persons involved in generating such profits. Criminals achieve this goal by disguising the source of funds, changing the form or moving the money to a place where it is less likely to attract attention.

Criminal activities that lead to money laundering (i.e., predicate crimes) can include: illegal arms sales, narcotics trafficking, contraband smuggling and other activities related to organized crime, embezzlement, insider trading, bribery and computer fraud schemes.

Laundering does not have to involve money at all, since the proceeds to be laundered can involve any sort of tangible or intangible property derived from crime. It is also the case that criminal property does not have to move for it to be laundered. For example, legitimately-earned money that has not been declared for tax may be placed directly into a bank account in a different jurisdiction from where it was earned. At this point it represents the profit from a legitimate activity but, because it has not been declared for tax in the jurisdiction in which it was earned, it becomes the proceeds of crime.

Similarly, the proceeds of frauds, bribery, corruption and insider dealing often involve the use and abuse of private limited companies and trusts set up in jurisdictions well away from the scenes of these crimes. In this way corrupt officials and criminals seek to distance the criminality from which they wish to avoid detection by arrangements designed to disguise the true ownership of those vehicles.

Money laundering may look like a polite form of white collar crime, but it is the companion of brutality, deceit and corruption. The process deprives governments of tax revenues, thereby raising the relative burden of honest citizens. Because of rapid movements of large amounts of money, normally stable financial institutions can become undermined, threatening the savings and retirement funds of thousands of innocent people.

The Three Stages of Money Laundering Process

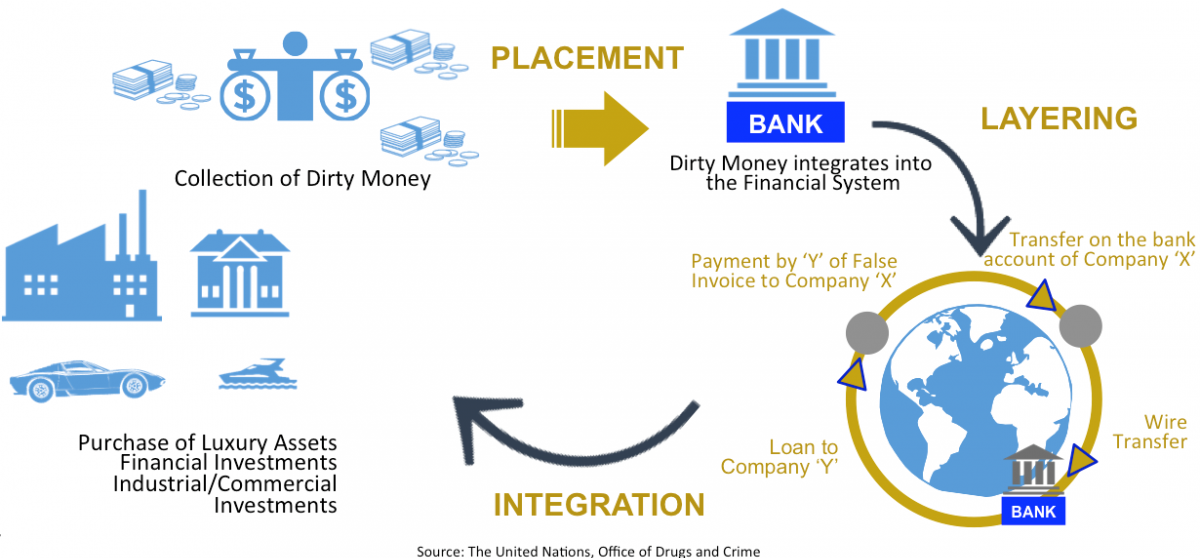

So how is money laundered? Well, generally a three-stage process is used. These stages are called placement, layering and integration. We now look at these in a little greater detail.

Placement is the physical disposal of the initial proceeds derived from the illegal activity. The first step is to introduce cash into the financial system.

The money launderers use various vehicles to do this e.g. deposits, money transfers, purchases of monetary instruments such as travellers’ cheques, bank cheques or money orders, foreign currency conversions etc. They may also use insurance companies, brokerage accounts, credit cards and other financial services to achieve this.

Layering is the separating of illicit proceeds from their source by creating complex layers of transactions designed to disguise the audit trail and provide anonymity.

Layering is like a shell game – many transactions and conversions take place to blur the trail back to the original crime. This may include investments, purchases of goods and services, cashing cheques, using several smaller cheques to purchase a bank transfer and so on.

Integration is the provision of apparent legitimacy to criminally derived wealth. The laundered proceeds re-enter the financial system, appearing as normal funds.

Integration is the final stage of the money laundering process. This is when the criminal re-introduces the funds into the legitimate economy with an apparently legitimate origin. Examples include investing in a company, purchasing real estate, luxury goods, etc.

What is the extend of Money Laundering?

According to UNODC (United Nations Office for Drugs and Crime) it is estimated that the annual value of money that is laundered globally is between 2% and 5% of global GDP. In cold hard numbers this puts the amount at between US$800 billion and US$2 trillion. This is a frightening set of numbers.

Consequently, in most jurisdictions anti-money laundering (AML) laws are aimed at identifying personal customers and the ultimate beneficial ownership of corporate customers, monitoring transactions, keeping good records and reporting suspicions to the authorities.

If you are interested in learning more about AML and Fraud Prevention attend our relevant upcoming courses, if you are interested in becoming certified in AML please check out the Certified Anti-money Laundering Specialist (CAMS) qualification preparation course, if you are more interested in self-study from anywhere then check out our online courses.